Navigation Map Download our best practices

- strategy (insurance, health, investments, finances);

- sustainable development (sales, employees, social responsibility, natural environment and ethics).

The above-mentioned areas were additionally supplemented with related GRI indicators, within each selected issue.

In the CHAPTER

GRI

- 102-7 Scale of the reporting organization

- 103-2 Approach to management and its elements

- 103-3 Evaluation of the approach to management

- 201-1 Direct economic value generated and distributed

- 102-13 Membership in associations and organizations

- 102-40 List of stakeholder groups engaged by the reporting organization

- 102-42 Basis for identification and selection of stakeholders engaged by the organization

- 102-43 Approach do engaging stakeholders, including the frequency of engagement by stakeholder type and group

- 102-44 Key issues and concerns raised by stakeholders and the organization’s response, also by reporting them

In the CHAPTER

GRI

- 102-8 Data pertaining to employees and other persons working for the organization

- 103-2 Approach to management and its elements

- 103-3 Evaluation of the approach to management

- 404-1 Average number of hours of training per year per employee

- 404-2 Managerial skill development and continuing education programs supporting continuity of employment of employees and facilitating the retirement process

- 404-3 Percentage of employees subject to regular assessments of work quality and professional development reviews, by gender and employment category

- G4-FS16 Initiatives to enhance financial literacy by type of beneficiary

In the CHAPTER

In the CHAPTER

GRI

- 103-3 Evaluation of the approach to management

- 307-1 Cash value of penalties and total number of non-financial sanctions for non-compliance with the law and/or regulations on environmental protection

- 301-1 Raw materials/materials used by weight and volume

- 302-1 Energy consumption by the organization, taking into account the types of raw materials

- 302-4 Reduction of consumption of energy

In the CHAPTER

GRI

- 102-9 Description of the supply chain

- 102-11 Explanation of whether and how the precautionary principle is addressed by the organization

- 102-15 Description of key impacts, opportunities and risks

- 102-16 Organization’s values, code of ethics, principles and norms of behavior

- 102-17 Internal and external mechanisms making it possible to obtain advice regarding the behaviors in ethical and legal issues and issues associated with the organization’s integrity

- 103-2 Approach to management and its elements

- 103-3 Evaluation of the approach to management

- 102-5 Organization’s form of ownership and legal form

- 102-18 Organization’s supervisory structure along with the commissions that report to the highest supervisory body

- 205-1 Actions assessed in terms of threats associated with corruption

- 205-2 Communication and training on anti-corruption policies and procedures in the organization

- 206-1 Legal steps taken against the organization for cases of violating the principles of free competition and monopolistic practices

- 405-1 Composition of supervisory bodies and employees broken down into employee groups by gender, age and other diversity factors

- 406-1 Total number of discrimination cases and corrective measures taken in this regard

- 419-1 Non-compliance with the law and socio- economic regulations

In the CHAPTER

GRI

- 103-2 Approach to management and its elements

- G4-FS13 Access points to sparsely populated areas that are less economically developed

- G4-FS14 Initiatives undertaken to improve access to financial services for disfavored persons

- G4-FS15 Policies for the fair design and sale of financial products and services

- 417-1 Internal requirements concerning the labeling of products and services and information regarding them

- 417-2 Incidents of non-compliance with regulations and voluntary codes concerning the labeling of products and services and information regarding them

- 417-3 Incidents of non-compliance with regulations and voluntary codes concerning marketing communications

Read more:

- Client at the center of attention

- Innovations

- Responsible sales

- Insurance

- Banking and strategic partnerships

- Working conditions

- Employee development

- Knowledge sharing

- Enhancing safety

- Health

- Improvement of living conditions in local communities

- Our impact on the natural environment

- Practical challenges in managing direct impact

- Products and adaptation to climate change

Business model

Employee

CSR

Environment

- Ethical foundations of business operations

- Preventing corruption and conflict of interests

- Diversity and respecting human rights

- Whistleblowing system

- Transaction security

- Risk management, taking into account non-financial risk

- Risk appetite

- PZU Group’s risk profile

- Reinsurance operations

- Polish and Baltic States insurance sector compared to Europe

- Regulations pertaining to the insurance market and the financial markets in Poland

- Non-life insurance (PZU, LINK4 and TUW PZUW)

- Life insurance (PZU Życie)

- International operations

- Contribution made by the market segments to the consolidated result

Risk and ethics

Market

Business

Financial results

Read more:

- Client at the center of attention

- Employee development

- Health

- Cultural patronage

- Practical challenges in managing direct impact

- Ethical foundations of business operations

- Diversity and respecting human rights

- Whistleblowing system

- Transaction security

- Risk appetite

- PZU Group’s risk profile

- Risk vulnerability

- Capital management

Business model

Employee

CSR

Environment

Risk and ethics

Read more:

- New approach to sales

- Working conditions

- Employee development

- Diversity and respecting human rights

Business model

Employee

Risk and ethics

Read more:

- Client at the center of attention

- Medical services (Health)

- Working conditions

- Enhancing safety

- Health

Business model

Employee

CSR

- Our impact on the natural environment

- Practical challenges in managing direct impact

- Diversity and respecting human rights

- Medical services (Health)

Environment

Risk and ethics

Business

Strategy operationalization

12 strategic initiatives (in 4 areas: data analysis, cross selling, digitalization of processes and client interactions) define the path to achieving the ROE target > 22%.

#nowePZU 2020 strategic initiatives

1 Objective to be confirmed after the enactment of the Act on Employee Capital Schemes

#1 Joint CRM

Initiative: combine PZU’s databases under a single CRM (customer relationship management) system / obtain a full client picture (360 degree view).

Purpose:

- effectively customize the offer to client needs in terms of quality and costs alike;

- align pricing to risk better;

- accelerate the procurement process and streamline service processes by providing clients with tools to manage easily the products they have in the overall PZU Group;

- create a full client picture (360 degree view) to cultivate partnership relations, standardize processes, grasp client needs better, underwrite risk in an optimum fashion, pursue more effective cross-sales efforts and manage the sales network more efficiently.

Metric: percentage of marketing consents and client contact data in PZU and PZU Życie.

Percentage of marketing consents in PZU

Percentage of marketing consents in PZU Życie

Execution:

- an integrated CRM platform was launched in 2018 – to help PZU agents and employees gain easy and rapid access to information pertaining to products and services. The full client view will make it possible to craft a new dimension of relations and refine cross selling in the PZU Group. Salespersons obtain up-to-date information concerning clients’ active products, anniversaries, expiry dates and event histories. The system also prompts new products aligned to client needs. As a result, this will allow us to build strong client relations and augment loyalty and satisfaction. Moreover, the available information can be used to match to a greater extent the product offer and preferences to clients’ actual needs in terms of the frequency, timing and method of contact with PZU, and for a salesperson to glean better familiarity with clients’ current standing in the PZU Group;

- work continued on a system facilitating comprehensive fraud identification (FMS) within the framework of building an effective CRM system. This system is based on advanced analytics and behavioral models providing support in processes to enter into contracts and handle damages. Its usage will affect the profitability of the product groups at risk and the offer’s price attractiveness to the final client.

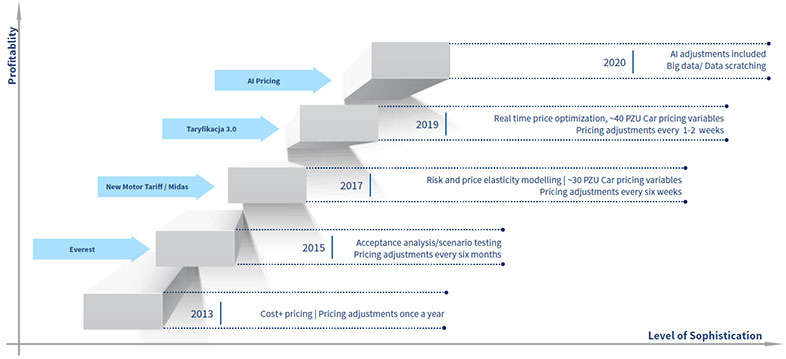

#2 More effective tariff setting

Initiative: shorten the tariff-setting process, in particular on the motor insurance market.

Purpose:

- optimize online prices;

- align prices to risk better;

- offer greater price elasticity;

- maintain a highly competitive position;

- improve sales results and profitability.

Better matched price to risk and price sensitivity (Tariff setting 3.0)

Metric: combined ratio (COR) (measure of profitability in non-life insurance).

Execution:

- work was underway in 2018 on a project to optimize prices in real time (assuming that models would be adjusted every 1-2 weeks). This system is based on machine learning using data originating from the Everest system. In 2018 pilot programs were run on parts of the new system;

- emphasis was placed in streamlining the tariff-setting process in the corporate segment to implement a new risk management model for the Everest policy administration system. A telematic offer was also implemented to align prices better to the loss ratio in client fleets.

#3 Artificial intelligence

Initiative: tap into new technology solutions harnessing proprietary resources and collaborating with the startup community (insurtech, fintech, technology firms).

Our aspiration is for the following business areas to benefit from these changes first: tariff-setting and risk management, sales, client retention and claims handling, as well as medical diagnostics.

Purpose:

- support cross selling initiatives;

- grow the client retention ratio in various lines of business;

- analyze pictures and images in claims and benefits handling processes (e.g. comparison in real time of the picture of the claim and the cost estimate received);

- smart solutions in medical diagnostics;

- enhance efficacy in the detection of insurance fraud;

- render risk management consulting services for companies;

- launch the PZU Data Lab - center for the creation of innovations based on data and artificial intelligence.

- cut expenses;

- enhance quality in client service;

- augment client loyalty;

- build a competititve edge,

- improve sales and profitability;

- grow the value of the brand and the Company.

Metric: number of innovative solutions which at least 100 thousand clients of the PZU Group have used.

Number of innovative solutions

Execution:

- tests of a telematic solution were begun in 2018 to enhance drivers’ safety. PZU GO is a telematic app for a smartphone connected to a small beacon attached to a car’s windshield. A set of sensors makes it possible to detect an emergency situation and dispatch a signal to PZU’s alarm center that will make contact with the driver in question to furnish the requisite support. If it is not possible to make contact with the car driver, rescue services will be sent to the accident site. Additionally, under partnership programs, PZU GO will also provide a benefit package for drivers with a PZU policy and in the future also cheaper motor insurance policies for the best of them. The beacon is self-sufficient and is capable of operating on a single battery for two years. Series of pilot projects with the involvement of the Group’s employees were run in 2018 to augment the effectiveness of the system. In December this solution was furnished to clients, selected tied agents, PZU branches and outlets in Masovia and Silesia. More than 300 devices were already in operation at the end of February 2019. There are plans to enrich the device with new functionalities and make it available to a broader group of clients. On 10 February 2019 PZU GO detected the first very grave road accident. The PZU Emergency Center immediately contacted the driver and summoned rescue services and road assistance. PZU’s clients who were injured in the accident were hospitalized and their vehicle was safely towed to a workshop;

- the Data Lab analytical environment was formed under the #nowePZU strategy for the purpose of experimenting with large data files – to design analyses rapidly and test analytical hypotheses. This agile ecosystem supports the conduct of pilot projects in short order in cooperation with the best experts on Big Data and Data Science in Poland. In 2018 DataLab and its partners ran projects regarding underwriting based on pictures and rapid quotation when buying real estate insurance on the web.

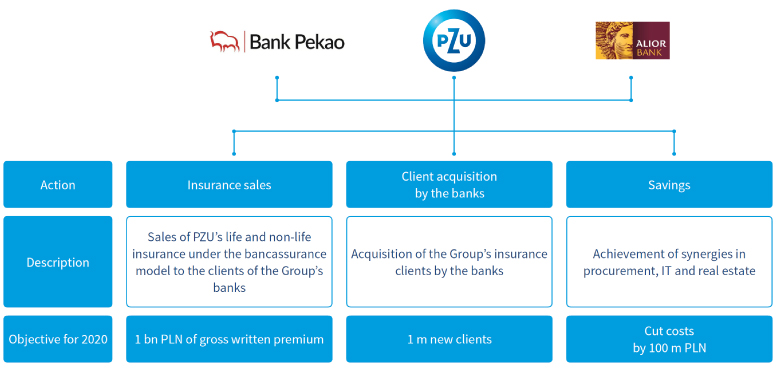

#4 Cooperation with banks

Initiative: cooperate with the banking segment in the PZU Group.

Purpose:

- sell insurance to the clients of Bank Pekao and Alior Bank;

- bring new insurance clients from PZU to these banks;

- cost savings in the area of the real estate and purchasing administration system through the creation of an integrated property administration system, or a common purchasing model.

Metric: number of clients attracted to the Group’s banks, premium in the banking channel, cost cutting as a result of collaborating with banks.

Amount of premium generated in collaboration with banks

Cost cutting as a result of collaborating with banks

Execution:

- 24 insurance products were rolled out in the banking offer in 2018, thereby ensuring the presence of PZU’s products in all the banks’ product lines, while PZU has several leasing bundles in leasing companies containing motor, property and financial insurance. The PZU Group including the banks plans to deploy another fifteen or so products in 2019. Preparatory work (formal legal, business and technology analysis, among others) in assurbanking was also conducted. Several thousand clients were solicited during the pilot period.

#5 Simplifying the product offering

Initiative: create a straight-forward product offer in respect of how the products are structured and the wording used.

Purpose:

- have general salespersons sell simple products effectively;

- increase simplicity and shorten the process for clients to buy products;

- make the simple offer available through the web (10 widely distributed products).

Metric: number of products in general sales.

Number of products in universal sales

Execution:

- analytical work was conducted in 2018 to define the optimum rules for carrying out the new distribution, tariff-setting and sales process. The crucial issue for this process was to design a rapid implementation path for new products.

- the work in this area also pertained to modifying how we communicate with clients. The purpose was to simplify the language of communication with clients. In 2018 changes pertained in particular to debt collection, retail sales and messages in the #myPZU service. The deployment of standards in internal communication and recruitment was also kicked off.

#6: Converting the sales network into a general sales network

Initiative: modify PZU’s proprietary networks in the direction of becoming more universal in nature. This project applies to channels fully controlled by the PZU Group: branches, tied agents in life and non-life insurance and the corporate sales network.

Purpose:

- approximately 5 thousand general salespersons (i.e. 50% of the Group’s proprietary network) by 2020;

- distribution of at least 3 of the 5 lines of business (life insurance, non-life insurance, medical care, investment products, banking products) by general salespersons.

Metric: percentage of generalist salespersons in our proprietary networks.

Percentage of generalist salespersons in our proprietary networks

Execution:

- the generalist sales strategy also entails enhancing the elasticity of the corporate sales network; changes were made to its structure and motivation, training and development systems. Sales processes were simplified and salespersons have obtained extended powers to submit offers.

#7: Development of sales in PZU Zdrowie

Initiative: build PZU Zdrowie’s size and profitability. Build a competititve advantage by tapping into technology and the high quality and accessibility of services.

Purpose:

- develop new health insurance products and expand the “traditional” offering to include unique riders;

- activate the sales network and tap into the full potential rooted in the PZU Group’s client base;

- offer a modern patient service process giving consideration to the best practices on the market, innovative technological and medical solutions and quality of service standards, including VIP care;

- develop a network of proprietary centers through greenfield and M&A projects.

Metric: PZU Zdrowie’s revenues (PLN million) and EBITDA (%).

PZU Zdrowie’s revenue

PZU Zdrowie’s EBITDA margin

Execution:

- in 2018 the solution was implemented in full to allow the clients and consultants on the PZU Zdrowie hotline to book medical benefits in selected centers through the online channel. More centers are added to the system as the integration process progresses.

- within the framework of product-related development work sales was launched in the Everest system of the following products: PZU Auto Asystent Zdrowotny, PZU Dom Asystent, PZU Wojażer Kontynuacja leczenia po podróży and PZU Plan na Zdrowie;

- PZU developed and tested a symptom checker platform based on artificial intelligence in cooperation with a Polish technology start-up; it will be available on the patient portal in an app and also in the form of a dedicated solution for medical hotline employees. The purpose of the platform is to conduct a patient check-up, which is very similar to when a physician conducts an examination, followed by presenting the most probable solution and defining the next steps. This may be phone consultation, video consultation or a chat with a doctor or a visit in a clinic to with a specific specialist. However, in many cases such a discussion with a patient may end with an advice or a prescription sent without any need to leave home.

- to build size PZU Zdrowie cultivated cooperation with partner centers and acquired new centers. At the end of 2018 PZU’s network had more than 2,100 partner centers in more than 500 cities in Poland and over 60 proprietary branches.

#8: Development of sales and consolidation in PZU Investments

Initiative: design a uniform asset management structure in the PZU Group to utilize multi-channel distribution. Products are also supposed to be sold on international markets within the strategy’s horizon up to 2020.

Purpose:

- achieve cost synergies (one factory of investment products);

- ratchet up sales by deploying new investment products based on indices or on what is known as “life cycle”;

- utilize the changes ensuing from the reform of the pension system - Employee Capital Schemes;

- growth the net result on asset management.

Metric: third party assets under management (PLN billion), net result on asset management (PLN million), percentage of assets on the employee capital schemes (ECS) makret.

Net result on third party asset management

Third party assets under management

Execution:

- in 2018 educational and preparatory efforts were conducted for the new product offer – ECS (Employee Capital Schemes). News on PZU’s efforts was reported in the traditional and internet trade media. A special website emerytura.pzu.pl was also created where current information is published on the upcoming changes. Using that site it is possible to calculate the planned pension benefits coming from saving under the ECS and subscribe to a newsletter. Strategic efforts and efforts to align the business and operating architecture to sell this product were conducted on the business side of things. Moreover, training courses were delivered to salespersons.

- As the leader on the group and voluntary savings market under EPP (roughly PLN 5.3 billion in assets), PZU TFI has rich experience in pension solutions. Its thorough market intelligence, extensive client base, high cost effectiveness, size of operation and rich experience enable TFI PZU to offer attractive terms and conditions in this new formula;

- in October 2018 the new internet inPZU transaction service to sell mutual funds was launched. This service directly reaches retail clients with its new offer of index funds. Client service is done solely in the online channel without having to pay a visit to a branch while the platform is available on all network-enabled devices. inPZU has enabled the Group to build the first offer of low cost index funds in Poland and grow TFI PZU’s revenue;

- a modern system to handle the overall investment, finance and accounting process to handle, value and record invesments was deployed in TFI PZU in 2018. In addition, implementation work is in progress on a comprehensive business solution handling the overall investment process from analysis and submitting orders to clearing and confirming trades to risk management and comprehensive reporting at the PZU Group level (PZU, PZU Życie, TFI PZU) in accordinace with the binding legal regulations and KNF’s guidelines.

#9: Implementation of a new „moje.pzu.pl” portal

Initiative: integrate the digital services surrounding the PZU Group’s processes. The largest project under this initiative is the “moje.pzu.pl” portal.

Purpose:

- gather in a single place client information translating into loyalty and more transactions;

- provide clients with a functionla dashboard enabling them to check their insurance and health coverage at any time (book appointments, too) and manage their investments and, in the future, banking services as well.

Metric: number of accounts established by clients (5 million accounts by 2020).

Execution:

- the “moje.pzu.pl” portal was launched in 2018; it integrates the PZU Group’s services and allows clients to manage their health and insurance cover and buy policies. More functionalities are steadily being added. The launch of the “my.pzu.pl” portal was one of the largest IT projects in PZU. The work related to launching the platform called for the integration of more than 20 IT systems and numerous project teams toiled on it. As a result, more than 100 million records pertaining to clients and their services were processed. At the end of 2018, the portal had more than 100 thousand accounts. Promotional efforts to raise awareness about using the platform when handling products are slated to be taken in 2019;

- the new unveiling of the pzu.pl portal transpired in H2 2018. This portal supports the online purchase of products, reporting claims and booking appointments under private medical care and contacts with an insurance agent. This new portal features a modern design, straight forward communication, intuitive navigation and responsiveness (customized to every device);

- the service zgłoszenie.pzu.pl was launched in 2018 in which it is possible to report a loss or a claim at a record-breaking fast pace and determine its value. In motor and non-life claims clients receive an automatically calculated proposal of the indemnity payment. The new tool has also been made available for use by Contact Center employees. That means that registration through our information line takes less time. The content of this service was the subject matter of consultation with the Institute of Simple Polish at the University of Wrocław; clear and comprehensible graphics and photos were used. This platform is adapted for use on mobile devices. The outcome of these efforts is the shortening of the time it takes to register claims from 15 to 5 minutes. The number of cases registered by the internet service has jumped up by nearly 20%;

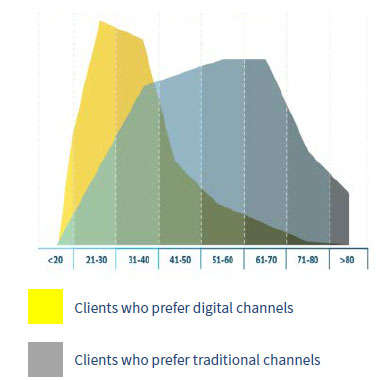

#10: Development of the direct offering

Initiative: Develop the best sales site in the online channel among European insurers.

Purpose:

- design an offer of 10 products based on simple and understandable rules;

- reach clients who prefer digital channels;

- build a leadership position in the direct channel with a market share of at least 50%.

Reaching clients who prefer digital channels

Metric: number of products available in the direct channel (Internet and telephone); market share held by PZU and Link4 of the non-life insurance sold in the direct channel (at least 50% by 2020)1.

Number of products in the direct channel

Execution:

- 7 insurance, health and investment products were deployed in the direct offer in 2018. To date, the following insurance products have been available in PZU’s online sales: car, home/apartment, travel (Voyager), individual retirement security account (IKZE), JaPlus, inPlus and FFS (medical benefits falling outside the scope of a subscription).

#11 Loyalty program

Initiative: launch a loyalty program for the overall Group spanning all its products. The points collected by using these services as well as other activities (among others having a claim-free history and referring the program to a friend) may be converted into products and services from our partners.

Purpose:

- grow the number of client interactions;

- expand the range and reach new target client groups (solicit young clients too) and align the offer better;

- segment clients and personalize the offering;

- support the development of all of the lines of business;

- engage club members to act to benefit the local communities in which they live.

Metric: number of participants in the loyalty program.

Execution:

- conceptual work got started in 2018 in the PZU Club – new space for client contacts.

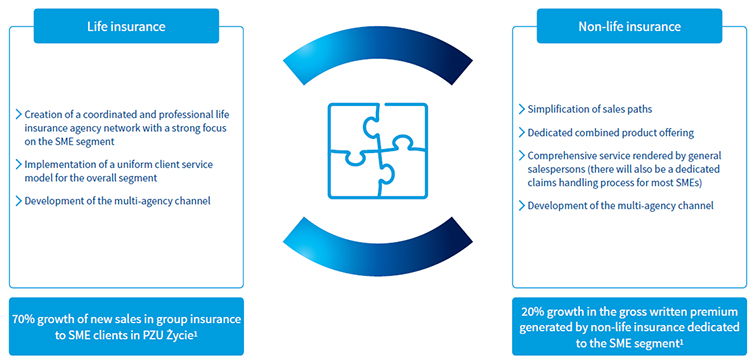

#12 Integrated service model for SMEs

Initiative: zintegrate sales models in the Small and Medium Enterprise (SME) segment.

Purpose:

- ramp up the sales of group and property insurance to the small and medium enterprise (SME) segment;

- reorganize and unify the sales and service model, develop a multi-agency channel;

- create dedicated product offerings for the SME segment.

Metric: pace of new sales of in group insurance to SME clients in PZU Życie (70% up to 2020 - versus 2016), pace of growth of gross written premium on property insurance dedicated to the SME segment (20% up to 2020 – versus 2016).

Integrated service model for SMEs

1 Value generated in 2020 compared with 2016

Gross written premium growth in non-life insurance in the SME segment

Execution:

- reorganization processes in the sales of group products were conducted in 2018. The Product Factory project was launched, i.e. a modular offer for SME clients making it possible to take a very flexible approach to products based on the nature of the risks involved. Special processes responding to client expectations for entering into contracts and obtaining after-sales service have been designed.

- the agency network model was reorganized under efforts focused on sales growth in 2018 with respect to dedicated sales structures, compensation and cost control as well as the employee structures to handle the SME portfolio.

1 As of the day of preparing this report the market data on the direct market structure in 2018 were not available.